Understanding (and Fixing) Cloud Finance Pain Points

As adoption of public cloud accelerates, new challenges emerge. One topic that we have not seen enough discussion on is how to account for cloud costs. Of course, there has been plenty of discussion about cloud expenses — what to consider, how to decrease them — but in the context of integrating cloud costs in accounting systems and workflow, the discussion has been much less prolific. Improving visibility and accountability for finance is a core component of cloud governance and, more specifically, FinOps, or cloud financial operations. Therefore, we wanted to offer cloud accounting guidance that organizations can easily implement.

Cloud accounting challenges

In the accounting world, there is already a science around the measurement and allocation of revenue and expenses. However, the current system does not often factor in the specifics and nuances of the cloud. The cloud converts much of what was historically fixed costs into variable costs.

A specific example of these challenges is accounting for Reserved Instances (RIs) in Amazon Web Services (AWS). AWS provides a multitude of options for purchasing RIs. The two most relevant options are duration of reservation and amount of upfront payment. AWS currently offers one-year or three-year commitment options. Payment options include All Upfront, No Upfront, and Partial Upfront. The more money you put upfront and the longer the period you commit for, the greater the discount you will receive.

When you purchase a three-year All Upfront RI, you are in essence prepaying for three years of usage for compute power. With accrual accounting, you cannot simply take the entire payment as an operating expense upon prepayment and then recognize zero expenses for the remaining three years. In these cases, you should be capitalizing the three years of payments and amortizing those over the 36-month period. From AWS you will receive an invoice that includes the full payment. Recording this payment as an expense is not accurate, and results in initially overstating expenses followed by understating expenses.

In the past, the amounts were so small that the problem was not material. Most accounting departments following generally accepted accounting principles (GAAP) standards simply ignored the issue. Now, as we are seeing the IaaS spend gaining critical mass, the issue is more substantial. As such, finance departments must begin accounting for RI purchases using appropriate accrual methods — or face material misrepresentations in their financial statements.

Multi-cloud cost management — all in one platform

Learn how CloudCheckr solves problems for FinOps, DevOps, SecOps, InfoSec, and other business leaders.

Download the eBook

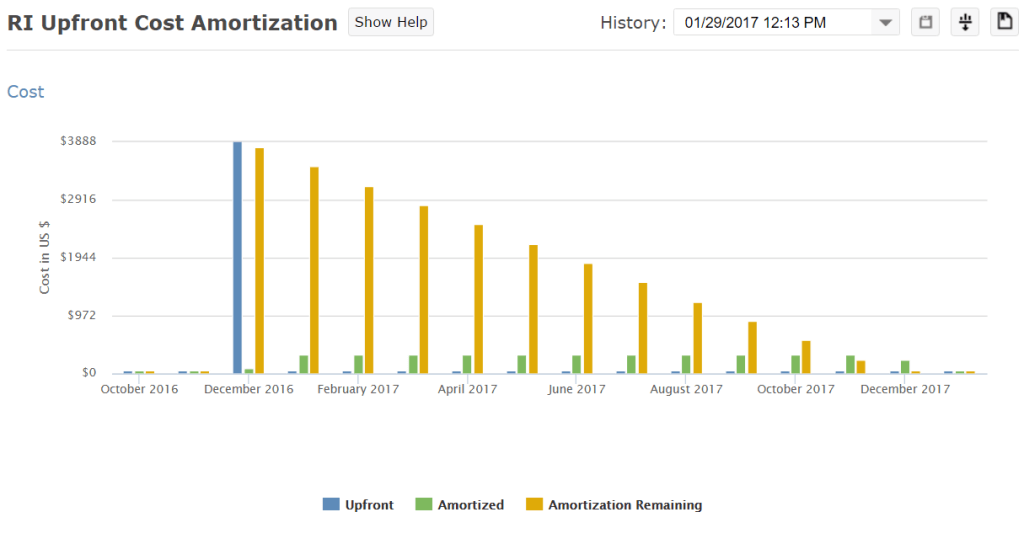

Breaking down RI amortization

Being able to get detailed amortization of the potentially large upfront costs associated with RIs, as well as quick access to the data, are both key to getting an accurate picture of cloud spend. Tracking and visualizing amortization across your consolidated billing family is easy within CloudCheckr, because you are able to quickly see any RI purchases as well as their amortized upfront costs and remaining unamortized value.

As shown below, you can search by a custom date range and get a complete data set on when you bought the RI (the upfront cost shown in blue), how much of the upfront charges are being amortized by month (shown in yellow), and how much amortization by month (shown in green).

Below is a more detailed breakdown on all amortized amounts. For each month, you can see the complete info on RI purchases that occurred, including the Service, Reserved Instance ID, size, platform, and cost. Clear itemization of each amortized amount, the specific Reserved Instance that the amortization is based on, and the remaining unamortized amount, enables a deeper level of detail. The total amortized amount for the month is also provided, with filters for RIs by Service (EC2, ElastiCache, RDS, and Redshift).

Another challenge is amortizing RI costs to the appropriate projects or teams (via resource tags) within the organization. Use of RIs requires proportional amortization allocation based on usage hours. This means mapping a small piece of the upfront RI payment to each hour of usage for the RI; using tags that can be assigned to resources and tied back to RI usage enables this easily. The result is in the expected increase in cost when looking at numbers that have been processed.

These proportionally and hourly amortized costs can be seen by using CloudCheckr’s Advanced Grouping cost report, a key piece of cloud accounting guidance that the platform offers. In this report, you can pivot your accounts’ data to quickly reflect the true cost incurred by various business units’ RI spend across your organization.

Accounting standards for cloud computing

Another challenge is keeping up with FASB changes. We know how difficult it is for regulations to keep with fast-paced technology changes. A few years back, FASB proposed amendments for guidance around accounting for cloud costs. The guidance noted that without acquiring a license for software, you must account for the contract as a service agreement.

When you purchase a three-year contract for a server (a three-year RI), you’re paying for the right to use the software. Does this constitute acquiring a software license? You could make that argument. Then you must factor in how much of the RI payment is for software versus for hardware, and other usage. You could derive this number by comparing the cost type of different RIs to determine a software licensing cost.

FinOps Guidance for MSPs

Learn how to implement the six principles of FinOps within your organization.

Watch the Webinar

However, if you read and interpret further guidance, it sets parameters for determining if a contract is a software license. The customer has the contractual right to take possession of the software at any time during the hosting period without significant penalty. It is feasible for the customer to run the software on their own hardware or contract with another party unrelated to the vendor to host the software. Our interpretation of this would be that you can NOT account for RI costs as internal-use software in the scope of Accounting Standards Codification (ASC) 350-40, Internal-Use Software because you can not take possession of the software. Additionally, a Reserved Instance purchase is essentially a coupon for committed compute usage — not software. Therefore, an RI contract wouldn’t meet these requirements.

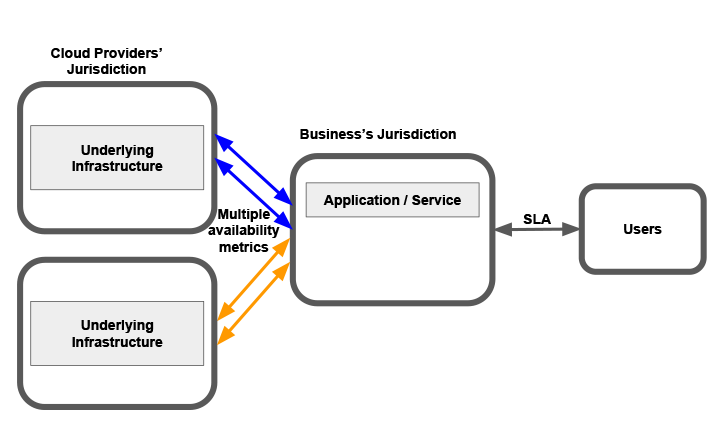

Unified visibility is just the beginning

The challenge of converting the account systems from fixed costs infrastructure (housed in proprietary data centers) to variable cost consumption models (in the cloud) is going to require some rethinking on the part of the finance team. They will need to spend time interacting and aligning with the operations and/or FinOps teams to optimize cloud costs.

Total visibility for cloud accounting guidance

CloudCheckr delivers comprehensive visibility — across multiple public clouds — making immediate cost savings achievable for even the most complex cloud infrastructures. From large enterprises and public sector agencies to cloud managed service providers, CloudCheckr customers deploy our SaaS solution, CloudCheckr CMx, to manage, optimize, and govern the most sensitive environments in the world.

Optimize Your Cloud Costs

Discover how CloudCheckr can simplify your cloud cost management.

Request a Demo

Cloud Resources Delivered

Get free cloud resources delivered to your inbox. Sign up for our newsletter.

Cloud Resources Delivered

Subscribe to our newsletter